February 19, 2020

#2270: Picking Bad Stocks explain

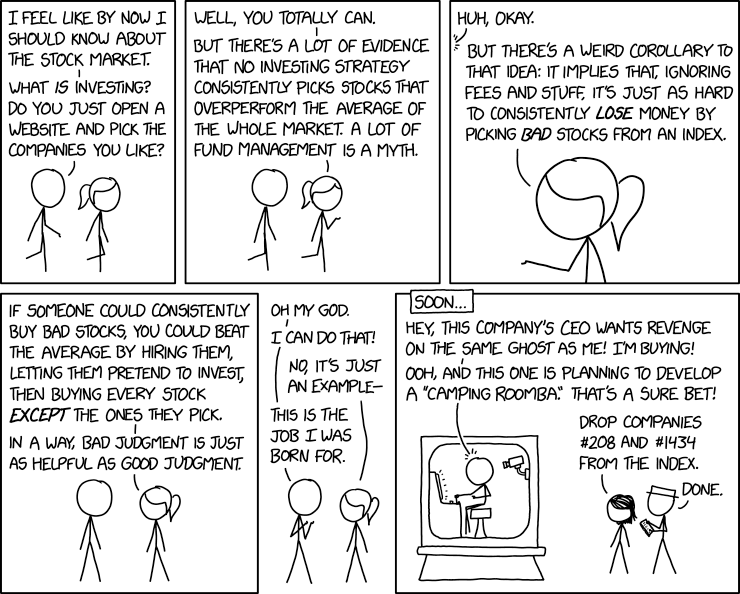

[Cueball and Ponytail are walking together.]

Cueball: I feel like by now I should know about the stock market.

Cueball: What is investing? Do you just open a website and pick the companies you like?

[Cueball and Ponytail are still walking; Ponytail is holding out her hand palm-up.]

Ponytail: Well, you totally can.

Ponytail: But there’s a lot of evidence that no investing strategy consistently picks stocks that outperform the average of the whole market. A lot of fund management is a myth.

[Close-up on Ponytail, who has turned to Cueball.]

Cueball (off-screen): Huh, okay.

Ponytail: But there’s a weird corollary to that idea: it implies that, ignoring fees and stuff, it’s just as hard to consistently lose money by picking bad stocks from an index.

[Cueball and Ponytail are both back in frame. They are standing still and facing each other.]

Ponytail: If someone could consistently buy bad stocks, you could beat the average by hiring them, letting them pretend to invest, then buying every stock except the ones they pick.

Ponytail: In a way, bad judgement is just as helpful as good judgement.

[In a frameless panel, Cueball and Ponytail are standing facing each other; Cueball is raising his hands.]

Cueball: Oh my God.

Cueball: I can do that!

Ponytail: No, it’s just an example–

Cueball: This is the job I was born for.

[Cueball is either sitting in a box or being viewed on a camera screen. He is sitting in front of a computer console, and a camera is pointed at him. Megan and White Hat are viewing him, and White Hat is holding a tablet.]

[Text box: Soon…]

Cueball: Hey, this company’s CEO wants revenge on the same ghost as me! I’m buying!

Cueball: Ooh, and this one is planning to develop a “Camping Roomba.” That’s a sure bet!

Megan: Drop companies #208 and #1434 from the index.

White Hat: Done.